On April 21, 2020, the Securities and Exchange Commission (SEC) proposed rule 2a-5 (Proposed Rule) under the Investment Company Act of 1940, as amended (1940 Act) that would provide the requirements for determining the fair value of a fund’s investments in good faith for purposes of section 2(a)(41) of the 1940 Act.

1 The Proposed Rule is intended to provide a consistent framework and standard of baseline practices for fair value and would apply to all registered investment companies and business development companies (BDCs). Comments on the proposal are due by July 21, 2020.

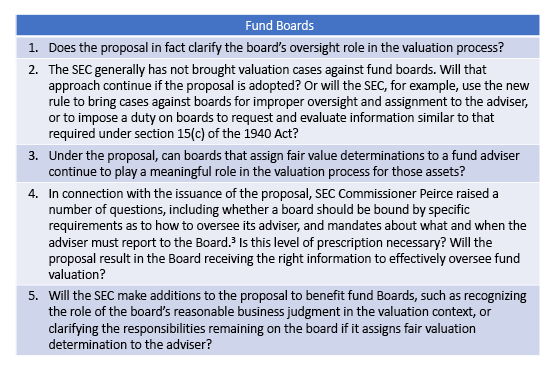

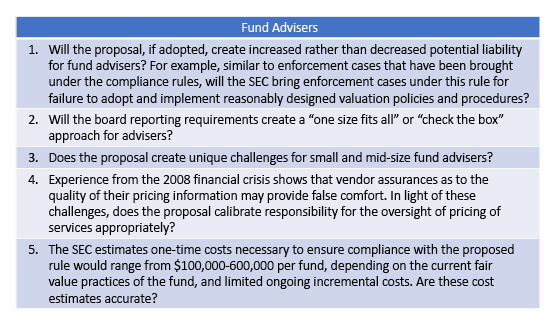

After summarizing the SEC proposal, this Alert concludes by highlighting 10 key issues for fund boards and fund advisers to consider.

I. Background

A. Valuation and Section 2(a)(41). Proper valuation is important for many reasons, including because it is the primary determinant of a fund’s net asset value (NAV) which many funds use to determine the price at which shares are offered, redeemed or repurchased. Valuation also impacts the accuracy of asset-based and performance-based fee calculations; disclosures of fund fees, performance and portfolio holdings; compliance with investment policies and limitations; and accounting and financial reporting obligations.

Section 2(a)(41) of the 1940 Act defines “value” as the market value of a fund’s portfolio securities when market quotations for those securities are readily available, and, when market quotations are not readily available, the fair value of the security or asset, as determined in good faith by the fund’s board of directors.

B. Past Significant Regulatory Developments. The SEC last comprehensively addressed valuation, including the role of the board in determining fair value, in two releases in 1969 and 1970, Accounting Series Release 113 (ASR 113) and Accounting Series Release 118 (ASR 118). In the Proposing Release, the SEC acknowledges that since the issuance of these two releases, markets and fund investment practices have evolved significantly.

The Proposing Release also describes three significant regulatory developments since 1970 that have changed the way boards, advisers, auditors and other market participants approach valuation. These regulatory developments are:

1. the Sarbanes-Oxley Act of 2002 (Sarbanes-Oxley Act), which established the Public Company Accounting Oversight Board (PCAOB);

2. the compliance rules under the 1940 Act and the Investment Advisers Act of 1940, in particular rule 38a-1 under the 1940 Act, which requires funds to adopt compliance policies and procedures, including with respect to fair valuation determinations; and

3. the Financial Accounting Standards Board’s ASC Topic 820: Fair Value Measurement (ASC Topic 820) in 2006 and 2009, which defines the term “fair value” for purposes of accounting standards.

II. The Proposal

The proposed rule has two main parts. Paragraph (a) establishes requirements for the determination of fair value in good faith. Paragraph (b) permits fund boards to assign the determination of fair value to the fund’s investment adviser (or sub-adviser), subject to certain conditions and oversight. The remaining portions of the proposed rule mainly provide certain definitions.

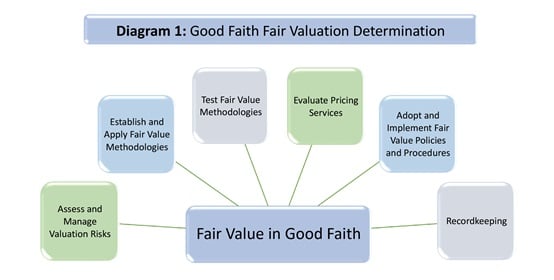

A. Fair Value Determinations. The Proposed Rule provides six requirements for determining fair value in good faith with respect to a fund’s investments. These requirements are summarized below and in Diagram 1.

1. Assess and Manage Valuation Risks. The Proposed Rule requires periodically assessing any material risks associated with the determination of the fair value of the fund’s investments, including material conflicts of interest and managing those identified risks. The Proposing Release also provides a non-exhaustive list of valuation risks that should be considered including:

- the types of investments held or intended to be held by the fund;

- potential market or sector shocks or dislocations;

- the extent to which each fair value methodology uses unobservable inputs, particularly if such inputs are provided by the adviser;

- the proportion of the fund’s investments that are fair valued as determined in good faith and their contribution to the fund’s return;

- reliance on service providers that have more limited expertise in relevant asset classes; the use of fair value methodologies that rely on inputs from third-party service providers; and the extent to which third-party service providers rely on their own service providers (so-called “fourth party” risks); and

- the risk that the methods for determining and calculating fair value are inappropriate or that such methods are not being applied consistently or correctly.

The Proposed Rule does not specify how frequently risks need to be assessed; however, the Proposing Release does provide that the frequency of re-assessment depends on the particular fund and its risks, and generally should take into account changes in fund investments, significant changes in a fund’s investment strategy or policies, market events and other relevant factors.

2. Establish and Apply Fair Value Methodologies. The Proposed Rule requires selecting and applying in a consistent manner an appropriate methodology or methodologies for determining the fair value of fund investments, including specifying:

- the key inputs and assumptions specific to each asset class or portfolio holding; and

- the methodologies that will apply to new types of investments in which a fund intends to hold in the future.

The selected methodologies would need to be periodically reviewed for appropriateness and accuracy, and adjusted as necessary (for example, in light of the results of back-testing or calibration). The Proposed Rule also requires establishing criteria for determining when market quotations are no longer reliable and monitoring for circumstances that may necessitate the use of fair value. Importantly, the Proposing Release recognizes that the SEC continues to believe that for any particular investment, there may be a range of appropriate values that could reasonably be considered to be fair value.

3. Testing of Fair Value Methodologies. The Proposed Rule requires testing the appropriateness and accuracy of the fair value methodologies, including identifying the testing methods to be used and the minimum frequency with which such testing methods are to be used.

4. Pricing Services. The Proposed Rule requires oversight of pricing services, including establishing a procedure for the approval, monitoring and evaluation of each pricing service provider, as well as the criteria for initiating price challenges. The Proposing Release provides a list of factors that should, in general, be considered during this evaluation, such as the:

- qualifications, experience and history of the pricing service;

- valuation methods or techniques, inputs and assumptions used by the pricing service for different classes of holdings, and how they are affected as market conditions change;

- pricing service’s process for considering price “challenges,” including how the pricing service incorporates information received from pricing challenges into its pricing information;

- pricing service’s potential conflicts of interest and the steps the pricing service take to mitigate such conflicts; and

- testing processes used by the pricing service.

5. Fair Value Policies and Procedures. The Proposed Rule would require the adoption and implementation of written fair value policies and procedures that are reasonably designed to achieve compliance with the requirements of the Proposed Rule described above. If the board assigns the determination of fair value to the adviser, these policies and procedures would be adopted and implemented by the adviser, subject to board oversight under rule 38a-1 of the 1940 Act.

6. Recordkeeping. The Proposed Rule requires the fund to maintain for five years documentation to support its fair value determinations and a copy of its fair value policies and procedures. The SEC believes that this recordkeeping requirement would be consistent with current record retention practices under rule 38a-1(d).

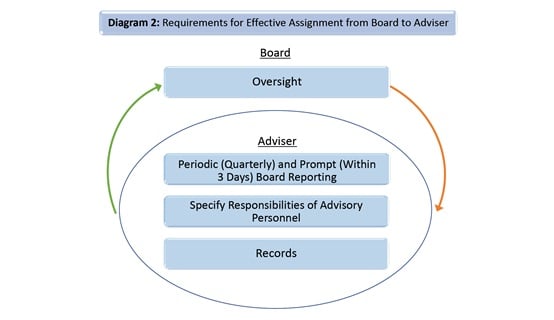

B. Performance of Fair Value Determinations. A fund board may choose to determine fair value in good faith for some or all of a fund’s investments by carrying out the functions described in Section II.A above. Alternatively, a board may assign such determinations to the fund’s investment adviser, who would carry out the functions listed in Section II.A above. This assignment would be subject to oversight and other requirements described further below and in Diagram 2. Regardless of its approach, a board will have significant oversight responsibility under the proposed rule. The assignment can be made to a fund’s primary adviser or one or more sub-advisers.2

1. Board Oversight. The Proposed Rule would require the board to oversee the adviser. The Proposing Release emphasizes that the board should approach an adviser’s fair value determinations with a skeptical and objective view that takes the fund’s particular valuation risks into consideration. The release states that oversight cannot be a passive activity. Instead, the board should view oversight as an iterative process in which they ask questions and seek relevant information, request follow-up information when appropriate, and take reasonable steps to see that matters identified are addressed. In particular, the Proposing Release recommends the board should, among other things:

- identify potential conflicts of interest, monitor such conflicts, and take reasonable steps to manage such conflicts (e.g., those of the investment adviser and other service providers);

- periodically review the financial resources, technology, staff and expertise of the assigned adviser, and the reasonableness of the adviser’s reliance on other fund service providers, relating to valuation;

- consider the adviser’s compliance capabilities that support the fund’s fair value processes, and the oversight and financial resources made available to the CCO relating to fair value;

- consider the type, content and frequency of the reports they receive. While a board can reasonably rely on the information provided, it is incumbent on the board to request and review such information as may be necessary to be fully informed; and

- inquire about material matters it becomes aware of and take reasonable steps to see that they are addressed.

2. Board Reporting. In the event the board assigns fair value determinations to the investment adviser, the Proposed Rule requires the investment adviser to provide periodic and, in certain circumstances, prompt reports to the board about its process for determining fair value. These reports and supplemental information should provide such information as may be reasonably necessary for the board to evaluate the matters covered in the report. They can take various forms, such as narrative summaries, graphical representations, statistical analyses, dashboards or exceptions-based reporting.

- Periodic Reporting: The investment adviser would be required to provide to the board at least quarterly a written assessment of the adequacy and effectiveness of its process for determining the fair value of the assigned portfolio of investments. These reports should, at a minimum, include a summary or description of the following information:

- material valuation risks;

- material changes to or material deviations from methodologies;

- testing results;

- adequacy of resources allocated to the fair valuation process;

- pricing services; and

- other information requested by the board.

- Prompt Reporting: The Proposed Rule also requires the adviser to promptly report in writing to the board on matters associated with the adviser’s process that materially affect, or could have materially affected, the fair value of the assigned portfolio of investments. These include a significant deficiency or a material weakness in the design or implementation of the adviser’s fair value determination process, or material changes in the fund’s valuation risks. The adviser would be required to report such matters no later than three business days after it becomes aware of the matter.

3. Specify Responsibilities. The Proposed Rule would require the adviser to specify the titles of the persons responsible for determining the fair value of the investments, including specifying the particular functions for which the persons identified are responsible. The Proposed Rule would also require the adviser to reasonably segregate the process of making fair value determinations from the portfolio management of the fund. The segregation requirement would not prevent portfolio managers from providing inputs into the fair value determination process.

4. Records of Assignment. In addition to the records required to be maintained as part of good faith determinations generally, the Proposed Rule would require a fund to keep additional records related to the fair value determinations assigned to the adviser. In particular, the fund would be required to keep (i) copies of the reports and other information provided to the board required by the Proposed Rule; and (ii) a specified list of the investments or investment types whose fair value determinations have been assigned to the adviser pursuant to the requirements of the Proposed Rule.

C. Readily Available Market Quotations. The Proposed Rule would provide that a market quotation is readily available for purposes of section 2(a)(41) of the 1940 Act with respect to an investment only when that quotation is a quoted price (unadjusted) in active markets for identical investments that the fund can access at the measurement date, provided that a quotation will not be readily available if it is not reliable. This standard is drawn from ASC Topic 820. The Proposing Release also makes clear that evaluated prices, indications of interest, and accommodation quotes are not by themselves considered readily available market quotations.

D. Rescission of Prior SEC Releases. If the Proposed Rule is adopted, the SEC would rescind two prior SEC releases, ASR 113 and ASR 118, and certain SEC staff letters and guidance relating to fair value determinations. The Proposing Release lists staff letters and guidance that would be withdrawn or rescinded, although it contemplates that other guidance might also be withdrawn or rescinded.

III. Observations

Whether, and if so how quickly, the SEC will adopt the valuation proposal is uncertain in light of, among other reasons, potential staffing changes at the SEC in connection with the Presidential election in November of 2020. In addition, fund boards and advisers may want to consider the following issues regarding how they might be impacted by the proposal:

__________________

1 Good Faith Determinations of Fair Value, Release No. IC-33845 (April 21, 2020) (Proposing Release).

2 The Proposing Release provides that in the context of multi-manager funds, when a sub-adviser is responsible for managing a portion of the fund’s portfolio, a board could assign the determination of fair value for the investments in that portion of the fund’s portfolio to that sub-adviser.

3 Hester M. Peirce, Commissioner, SEC, Statement on Good Faith Determinations of Fair Value under the Investment Company Act of 1940 Proposal (April 21, 2020).

Information contained in this publication should not be construed as legal advice or opinion or as a substitute for the advice of counsel. The articles by these authors may have first appeared in other publications. The content provided is for educational and informational purposes for the use of clients and others who may be interested in the subject matter. We recommend that readers seek specific advice from counsel about particular matters of interest.

Copyright © 2020 Stradley Ronon Stevens & Young, LLP. All rights reserved.