I. Introduction

At an open meeting on July 22, 2020, the Securities and Exchange Commission (SEC) voted 3-1 to adopt amendments to its proxy rules and to issue supplemental SEC guidance (Guidance) for investment advisers.1

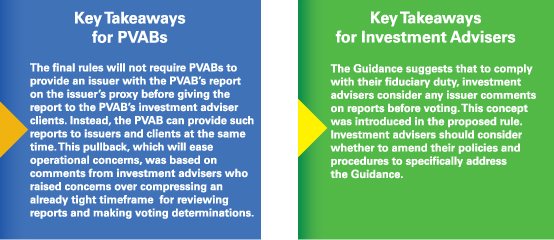

The amendments to the proxy rules impose a number of new requirements on proxy voting advice businesses (PVABs). The Guidance discusses the proxy voting responsibilities of investment advisers when using a PVAB, and in particular, it focuses on adviser responsibilities when using the electronic voting platform of a PVAB.

II. Amendments to Proxy Rules

A quick summary of the rule amendments is highlighted in this chart:

A. Definition of Solicitation

Section 14(a) of the Exchange Act and the rules thereunder govern the solicitation and voting of the proxies of issuers. The amendment to Rule 14a-1(l)(1)(iii) confirms that Proxy Voting Advice generally constitutes a “solicitation.” Under this amendment, a “solicitation” involves persons that make voting recommendations to shareholders and who market their expertise separately from other forms of investment advice and sell such advice for a fee. The amendment excludes persons who furnish reports only in response to an unprompted request from the definition of solicitation.2

Institutional Shareholder Services, one of the main PVABs, had filed a lawsuit challenging the SEC’s interpretation that proxy advice constitutes a solicitation. It is unclear whether that litigation, which was stayed pending the final rule, will move forward.3

B. The Exemptions

As noted above, PVAB’s may rely on exemptions from the definition of solicitation (in either Rule 14a-2(b)(1) or (b)(3)4 (exemptions)), provided that they meet certain conditions.5

a. Conflicts of Interest Disclosures

Disclosure Requirement. New Rule 14a-2(b)(9)(i) requires as a condition to reliance on the exemptions that a PVAB disclose in detail to clients material conflicts of interest so that PVAB clients can fully understand the nature and scope of such an interest, transaction or relationship. PVAB clients must also be provided with any policies and procedures used to identify, and steps taken to address any such material conflicts. These disclosures will have to be provided either in the PVAB’s reports or in an electronic medium, such as a client voting platform. The Release notes that these disclosures should be readily accessible to clients and facilitate their ability to consider such disclosures together with the report at the time they make their voting decisions.

b. Notice to Issuers and Safe Harbor

Notice Requirement. New subparagraph A to Rule 14a-2(b)(9)(ii) requires as a condition to reliance on the exemptions that a PVAB adopt and publicly disclose written policies and procedures reasonably designed to ensure that issuers have a report made available to them at or prior to the time when such report is disseminated to the PVAB’s clients. Provided that this initial notice is given to issuers, PVABs are under no obligation to provide issuers with additional opportunities to review the report, including if the report is later revised or updated in light of subsequent events. This condition does not apply to voting advice: (1) that is based on a “custom policy,” i.e., a policy proprietary to the client; and (2) regarding certain mergers and acquisitions and contested matters.6

Safe Harbor. New Rule 14a-2(b)(9)(iii) provides a non-exclusive safe harbor that a PVAB will be deemed to satisfy the notice requirement if it has written policies and procedures that are reasonably designed to provide issuers with a copy of its report, at no charge, no later than the time it is disseminated to the PVAB’s client.7

c. Mechanism to Become Aware of Issuer’s Response and Safe Harbor

Mechanism to Become Aware of Issuer’s Response. New subparagraph B to Rule 14a-2(b)(9)(ii) requires a PVAB, as a condition to relying on the exemptions, to adopt and publicly disclose policies and procedures reasonably designed to ensure it provides clients with a mechanism by which they can reasonably be expected to become aware of any written responses by an issuer to a report, in a timely manner before the shareholder meeting or other action.

Safe Harbor. A non-exclusive safe harbor is available if the PVAB provides electronic notice on its electronic client platform (or through email or other electronic means) that the issuer has filed, or has informed the PVAB that it intends to file, additional soliciting materials (and includes an active hyperlink to those materials on EDGAR when available). The PVAB must provide a hyperlink to materials even if it believes the information is non-material or false or misleading.8

C. Amendments to the Anti-Fraud Provision

Largely consistent with the proposal, the SEC amended Rule 14a-9, the anti-fraud provision for proxy solicitations, to add examples of what may be misleading within the meaning of the rule. The amendment provides that “the failure to disclose material information regarding proxy voting advice, such as the proxy voting advice business’s methodology, sources of information, or conflicts of interest” could, depending on the particular facts and circumstances, be misleading within the meaning of the rule. In response to comments that the examples would heighten legal uncertainty and litigation risk, the Release emphasizes that the examples do not change the rule’s scope or application or make “mere differences of opinion” actionable, and the rule is still grounded in materiality.9

III. Supplement to Commission Guidance Regarding Proxy Voting Responsibilities of Investment Advisers

The Guidance addresses an investment adviser’s fiduciary duty and obligations under Rule 206(4)-6 under the Investment Advisers Act of 1940 as it relates to the adviser’s use of a PVAB to exercise of voting authority on behalf of its clients and supplements prior guidance issued by the SEC last year.10 The Guidance reiterates that an investment adviser should have policies and procedures in place that are reasonably designed to ensure that it exercises voting authority in the best interests of its clients.11

This Guidance focuses on an adviser’s use of PVABs’ pre-populated and automated voting services, which some advisers use to more efficiently address the thousands of votes they may make during a short proxy season. While the final rule amendments no longer require a PVAB to provide an issuer the ability to review a report prior to the PVAB client receiving it, and the SEC did not pursue imposing a “speed bump” on automated voting,12 the Guidance puts the onus on advisers to create and maintain policies and procedures that address any issuer response to a report. The Guidance also suggests advisers should disclose details regarding its use of automated voting and get client consent to such practices. The Guidance recommends the following:

- Issuer’s Additional Soliciting Materials. Investment advisers follow policies and procedures that address situations where the adviser becomes aware of an issuer that has filed or intends to file additional soliciting material after the investment adviser has received the PVAB’s voting recommendation but before the proxy voting submission deadline.

- Review of Proxy Advisory Firm Agreement. An investment adviser that uses a PVAB’s pre-populated and automated voting services should review its agreement with the PVAB to ensure that any non-public information possessed by the PVAB relating to the proxy vote of the investment adviser is not used in a manner that would not be in the best interests of the adviser’s client. This includes information on aggregated voting intentions of the investment adviser’s clients.

- Informed Consent. An investment adviser wishing to use a PVAB’s automated voting service should obtain informed consent from its client prior to doing so.13 In particular, the investment adviser should disclose (1) the extent of its use of automated voting services and under what circumstances it uses such services; and (2) how its policies and procedures address the use of automated voting in cases where it becomes aware before the submission deadline for proxies to be voted at the shareholder meeting that an issuer intends to file or has filed additional soliciting materials with the SEC regarding a matter to be voted on. The Guidance recommends that an adviser’s policies and procedures address these disclosures.

IV. Conclusion

While the final amendments to the proxy rules are less prescriptive than the proposal, it is likely that PVABs will need to make some adjustments to their current practices, which may result in increased cost to clients and potential delays during the short proxy voting season. As Commissioner Allison Lee stated in her remarks opposing the adoption of the amendments, “The final rules will still add significant complexity and cost into a system that just isn’t broken” and “are still designed to, and will, increase issuer involvement in what is supposed to be independent advice from proxy advisory firms.”14 It will be interesting to follow whether, as has been suggested, PVAB advice becomes less independent (i.e., if PVABs bow to issuer pressure due to concerns about threatened litigation). It is unclear whether the proposed amendments to the shareholder submission/resubmission thresholds, which were not addressed in the Release, will be finalized.15

The Guidance constitutes the latest SEC foray into fiduciary duty of advisers. Advisers will have to balance competing concerns and consider a cost-benefit approach to the review of policies and procedures and disclosure. The Guidance was not subject to notice and comment, is quite prescriptive and suggests an unusual level of detail with regard to policies and procedures and disclosure to clients.16 The SEC’s ability to enforce the Guidance, therefore, is not clear. It is also unclear whether the SEC will attempt to second guess an adviser’s good faith efforts to conform to the Guidance and best interest determinations required therein.

1 Exemptions from the Proxy Rules for Proxy Voting Advice, Release No. 34-89372 (July 22, 2020) (“Release”); Supplement to Commission Guidance Regarding Proxy Voting Responsibilities of Investment Adviser, Release No. IA-5547 (July 22, 2020) (“Guidance”); Amendments to Exemptions from the Proxy Rules for Proxy Voting Advice, Release No. 34-87457 (Nov. 5, 2019) (“Proposal”); Commission Guidance Regarding Proxy Voting Responsibilities of Investment Advisers, Release Nos. IA-5325; IC-33605 (Aug. 21, 2019) (“Prior Guidance”). See also, Commissioners’ statements: Jay Clayton, Chairman, SEC, Proxy Voting – Reaffirming and Modernizing the Core Principles of Fiduciary Duty and Transparency to Provide for Better Alignment of Interest Between Main Street Investors and the Market Professionals Who Invest and Vote on Their Behalf (July 22, 2020); Hester M. Peirce, Commissioner, SEC, Statement at Open Meeting on Exemptions from the Proxy Rules for Proxy Voting Advice and Supplement to Commission Guidance Regarding Proxy Voting Responsibilities of Investment Advisers (July 22, 2020); Elad L. Roisman, Commissioner, SEC, Open Meeting to Adopt Amendments to the Proxy Solicitation Rules (July 22, 2020).

2 The final rule clarifies that the SEC does not intend this definition to cover investment advisers, and presumably broker-dealers, that provide reports as part of their advisory services: “[The rule] is not intended to include communications made in the normal course of business by other professionals to their clients that may relate to proxy voting. Instead, the amendment is intended to apply to entities that market their reports as a service that is separate from other forms of investment advice to clients or prospective clients and sell such advice for a fee.” Release, supra note 1, at 35 n.124. It is understood that investment advisers and broker-dealers routinely vote proxies for their clients, both with and without their clients’ explicit voting instructions.

3 The Release includes wording designed to preserve other portions of the rule should litigation be successful. See Release, supra note 1, at 136; Institutional S’holder Servs. Inc. v. SEC, No. 1:19-cv-03275 (D.D.C. Oct. 31, 2019).

4 Rule 14a-2(b)(1) exempts solicitations by persons who do not seek the power to act as proxy for a shareholder and do not have a substantial interest in the subject matter of the communication beyond their interest as a shareholder. Rule 14a-2(b)(3) exempts reports furnished by an adviser to any other person with whom the adviser has a business relationship.

5 PVABs are not required to comply with the Rule 14a-2(b)(9) conditions until December 1, 2021. However, this transition period does not apply to the amendments to the definition of solicitation and the anti-fraud provisions.

6 Commenters, including investment advisers, had argued that advice based on custom policies should not be required to be provided to issuers because those custom policies are formulated by and tailored to a particular client and based on proprietary and often confidential information.

7 These policies and procedures can contain conditions requiring that such issuers have filed their definitive proxy statement at least 40 days before the shareholder meeting and expressly acknowledged that they will only use the report for their internal purposes and/or in connection with the solicitation, and the report will not be published or otherwise shared except with the issuer’s employees or advisers.

8 The Release did clarify that inclusion of a hyperlink would not, by itself, make the PVAB liable for the content of the issuer’s hyperlinked statement.

9 See Release, supra note 1 at p.132.

10 See Guidance, supra note 1; Commission Guidance Regarding Proxy Voting Responsibilities of Investment Advisers, Release Nos. IA-5325; IC-33605 (Aug. 21, 2019) (“Prior Guidance”); see also Risk&Reward Client Alert, SEC Adopts Guidance on Proxy Advisory Firms and Proxy Rules (Aug. 29, 2019) (discussing the Prior Guidance).

11 Consistent with the terminology in the Release, the Guidance also uses the term PVAB rather than “proxy advisory firm,” which was previously used in the Prior Guidance.

12 As discussed in our prior client alert, the SEC requested comments on whether PVABs should be required to disable the automatic submission of votes unless a client clicks on the hyperlink and/or accesses the issuer’s response or otherwise confirms any pre-populated voting choices before the PVAB submits the votes to be counted. Risk&Reward Client Alert, New SEC Proposal May Complicate Proxy Voting & Engagement by Advisers (Nov. 19, 2019).

13 Informed consent requires that the adviser make full and fair disclosure such that the client is able to understand the material fact or conflict of interest and make an informed decision whether to provide consent. See Guidance, supra note 1.

14 Allison Herren Lee, Commissioner, SEC, Paying More For Less: Higher Costs for Shareholders, Less Accountability for Management (July 22, 2020).

15 It appears that this aspect of the rulemaking has been a point of contention in the SEC’s 2021 budget appropriation with Democrats seeking to prohibit the use of funds to finalize rulemaking under Rule 14a-8. See House Committee on Rules, H.R. 7617 – Defense, Commerce, Justice, Science and Energy and Water Development, Financial Services and General Government, Homeland Security, Labor, Health and Human Services, Education, Transportation, Housing, and Urban Development Appropriations Act 2021.

16 In this respect, it can be argued that the Guidance is subject to similar criticism as the recently proposed valuation rule. See Hester M. Peirce, Commissioner, SEC, Statement on Good Faith Determinations of Fair Value under the Investment Company Act of 1940 Proposal (April 21, 2020) (questioning whether the benefits of the proposed rule “may be diminished significantly by an overly prescriptive approach to ensuring adequate board administration of the fair valuation process.”)

Information contained in this publication should not be construed as legal advice or opinion or as a substitute for the advice of counsel. The articles by these authors may have first appeared in other publications. The content provided is for educational and informational purposes for the use of clients and others who may be interested in the subject matter. We recommend that readers seek specific advice from counsel about particular matters of interest.

Copyright © 2020 Stradley Ronon Stevens & Young, LLP. All rights reserved.