Our inaugural 2019 Risk&Reward will both get you up to speed on 2018 fiduciary-related developments that affected financial institutions, as well as preview the 2019 landscape. We’ll refrain from screaming predictions, that, while attention-grabbing, are unlikely to materialize. Instead, we will provide context and nuance that anchors our predictions. We take this role very seriously, considering that the Fiduciary Governance Group’s very genesis was in the heady days between the Department of Labor’s (DOL) fiduciary rule demise and the Securities and Exchange Commission’s (SEC) standard of conduct proposal. While standards of conduct will dominate our discussion and predictions, many other fiduciary issues also manifested themselves in 2018, including proxy voting and environmental, social and governance (ESG) investing, and those will be addressed, too.

DOL Fiduciary Rule

The DOL fiduciary rule was already in purgatory when we rung in 2018. While it was clear the rule was unlikely to survive in its Obama-era form, the question was more over whether a scalpel or wrecking ball would be the preferred instrument and whether it would be at the hands of Trump’s DOL or a court.

The administrative complaint filed against Scottrade by the Massachusetts Securities Division in February 2018 was the first salvo of the year. Here, William Galvin, Massachusetts’ Secretary of State, alleged that Scottrade violated the DOL fiduciary rule’s “impartial conduct standards,” and, therefore, violated state law. As we noted, “Massachusetts was effectively seeking to enforce the DOL rule.” The worry, of course, was that the complaint against Scottrade would be the first of many lodged by Massachusetts and others against firms who may have been working off policies and procedures put in place due to the DOL fiduciary rule but by then no longer strictly required. For now, however, no other such actions have been filed.

The second salvo occurred on March 15, 2018, when the Fifth Circuit Court of Appeals flatly rejected the fiduciary rule’s expansive scope of investment advice fiduciary status under the Employee Retirement Income Security Act of 1974 (ERISA), and with it, the prohibited transaction exemptive relief the DOL bundled together with the 2016 rule. Efforts by the states of California, New York and Oregon, along with the American Association of Retired Persons, to have the Fifth Circuit reconsider its judgment were unsuccessful. The DOL, unsurprisingly, declined to appeal the decision to the U.S. Supreme Court. Some wondered whether the ruling had nationwide effect; we believed it did. Our very own Bill Mandia said:

“I don’t see there being any question about the nationwide impact. The Fifth Circuit determined that the DOL’s actions were not a proper exercise of its statutory authority. That ruling should, under the Administrative Procedures Act, vacate the rule nationwide. The mandate is drafted in that manner because it provides that the Fifth Circuit ‘vacat[ed] the Fiduciary Rule in toto.’”1

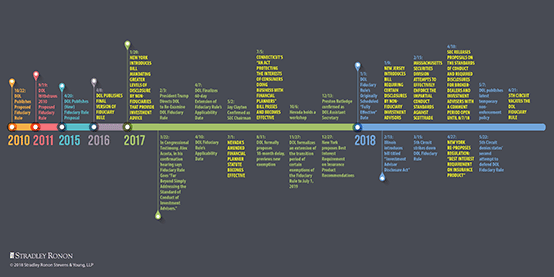

(Click image to enlarge.)

At first glance, the Court’s decision to toss out both the fiduciary rule and the related exemptions (e.g., Best Interest Contract Exemption) may seem like throwing out the baby with the bathwater. You will recall, however, that by the time of the Court’s ruling, most of the more complicated and expensive conditions of those exemptions had already been relaxed. As we cheerily noted in November 2017, “[a]n early holiday gift to many, the [DOL] on November 27 formalized an extension of the transition period of the Best Interest Contract (BIC) Exemption, the Principal Transactions Exemption, and certain conditions of Prohibited Transaction Exemption 84-24. The transition period will now end on July 1, 2019 rather than January 1, 2018.” The transition period was, by definition, transitory, and ultimately the DOL would have to find a final fix. In this sense, the Fifth Circuit saved the DOL from having to iron out enough of the 2016 rule’s wrinkles to make the rule (more) workable.

On May 7, 2018, the DOL issued Field Assistance Bulletin (FAB) 2018-02, which states that the DOL and Internal Revenue Service (IRS) will not bring an enforcement action against firms for non-exempt prohibited transactions that arise from providing fiduciary investment advice to plans and IRA holders when they exercise reasonable diligence and act in good faith in complying with the impartial conduct standards. This non-enforcement policy binds only the DOL and IRS; state regulators and private plaintiffs could potentially seek to bring an action for alleged non-compliance with the impartial conduct standards. The industry was already familiar with the impartial conduct standards because they were originally set forth in the Best Interest Contract Exemption.

The original five-part test now determines whether one is an investment advice fiduciary under ERISA. We expect that the DOL will issue interpretive guidance, and propose exemptive relief, in the summer or fall of 2019. The interpretive guidance will most likely address the circumstances under which rollover recommendations constitute fiduciary investment advice. The proposed DOL exemption will probably apply to services and products that the DOL views as presenting fewer conflicts of interest, one of the conditions being adherence to the final form of Regulation Best Interest (more on that, below). While we cannot completely predict whether multiple exemptions will be proposed, we can say, with some level of confidence, that the DOL is quite unlikely to modify the five-part test for when one becomes an investment advice fiduciary. We do not think the DOL has the appetite or bandwidth to do that.

SEC Best Interest Rulemaking Initiatives

Without question, the big fiduciary news of 2018 was the SEC’s April 18 release of its rulemaking proposals on the standards of conduct and required disclosures for broker-dealers and investment advisers who provide services to retail investors.

2 Though SEC Chairman Jay Clayton garnered four votes to secure the release of the proposal (Stein dissenting), the commissioners had enough misgivings to give the impression that a final rulemaking could look quite different from the proposal.

By way of background, the Dodd-Frank Act authorized the SEC to adopt rules on the standards of care for broker-dealers, investment advisers and their associated persons.

3 The SEC staff, in 2011, issued a

study recommending that the SEC engage in rulemaking to adopt and implement a uniform fiduciary standard of conduct for broker-dealers and investment advisers when providing personalized investment advice about securities to retail customers.

Last April, the SEC acted. The SEC did not, however, propose a uniform fiduciary standard. Rather, it proposed a best interest standard for broker-dealers that it characterized as an enhancement to existing standards (but separate and distinct from the fiduciary duty applicable to investment advisers). The SEC also proposed a new requirement for both broker-dealers and investment advisers to provide a brief relationship summary to retail investors, and it published for comment a proposed interpretation of the standard of conduct for investment advisers.

Proposed Regulation Best Interest would require broker-dealers and registered representatives to act in the “best interest” of a “retail customer”4 at the time a “recommendation”5 of a securities transaction or investment strategy involving securities is made to that customer, without placing the financial or other interest of the broker-dealer or associated person ahead of the interest of the customer.6

The SEC release states that the proposed best interest obligation both draws from principles applying to investment advice in other contexts where conflicts of interests exist, and builds upon the existing regulatory obligations in light of the unique structure of broker-dealer relationships with retail customers. The proposed best interest release reflects the underlying intent of many of the recommendations of the 2011 staff report, and also generally draws from the principles underlying the DOL’s 2016 fiduciary rulemaking.

Crucially, the SEC opted not to define “best interest,” and this omission has largely dominated the discussion over the entire proposed package. The proposed best interest standard is, in fact, not a fiduciary standard, such as the one imposed on investment advisers under the Investment Advisers Act of 1940 (Advisers Act). Rather, it’s a suitability-plus standard with enhanced disclosures and a requirement to mitigate or eliminate certain conflicts of interest. For example, the broker-dealer must establish, maintain, and enforce written policies and procedures reasonably designed to identify and then to, at a minimum, (1) disclose, or eliminate, material conflicts of interest associated with the recommendation; and (2) disclose and mitigate, or eliminate, material conflicts of interest arising from financial incentives associated with the recommendation.

We think that, most likely, Regulation Best Interest will be finalized this spring (in the fall at the latest) largely intact. We would not be surprised if the SEC opted to provide examples of how firms can meet their best interest duties, while still avoiding the rhetorical exercise of trying to define them.

The SEC also included title reforms for broker-dealers and investment advisers which include (1) a requirement of broker-dealers and investment-advisers to prominently disclose their registration status and (2) a prohibition against standalone broker-dealers and their financial professionals from using the terms “adviser” and “advisor” as part of their name or title.

We believe that the SEC is unlikely to adopt the proposed title reform changes given their limited application to just a few terms out of a possible universe of many, and the fact that this initiative was championed by Michael Piwowar, who has since left the SEC. If the SEC does not adopt title reform, we would not be surprised to continue to see state legislatures and regulators view this as an area of focus.

The SEC also proposed requiring that both broker-dealers and investment advisers provide retail investors7 with information intended to clarify the relationship via the proposed Form CRS Relationship Summary. Form CRS would be limited to four pages, with a mix of tabular and narrative information, and contain sections covering (1) the relationships and services the firm offers to retail investors; (2) the standard of conduct applicable to those services; (3) the fees and costs that retail investors will pay; (4) comparisons of brokerage and investment advisory services (for standalone broker-dealers and standalone investment advisers); (5) conflicts of interest; (6) where to find additional information, including whether the firm and its financial professionals currently have reportable legal or disciplinary events and who to contact about complaints; and (7) key questions for retail investors to ask the firm’s financial professional. Form CRS would be provided to investors, filed with the SEC, and available online.8

Form CRS has also proven to be a controversial component of the SEC proposal. If Form CRS was supposed to allay investor confusion over a broker-dealer standard of care and an investment adviser standard of care, the jury still appears to be out. While testing of the Form confirmed investors’ desire for clarity on standards of care, it is still an open question whether investors understand the Form or the concepts addressed in it. As a result, industry comments criticized Form CRS for adding to the confusion. We believe that the SEC will move forward with Form CRS, making some adjustments to address industry concerns and perhaps incorporating some of the models industry submitted.

One other aspect of the SEC standards of conduct package proposal is also worth watching. The SEC published for comment a proposed interpretation of the existing fiduciary duty owed by investment advisers under the Advisers Act. The proposed interpretation is intended to summarize the SEC’s understanding of that fiduciary duty and put the market on notice of the SEC’s views. This has been somewhat controversial within the adviser industry because some believe it goes beyond existing precedents, guidance and interpretations to impose new obligations on advisers. Most notably, the proposed release suggests that certain conflicts of interest may no longer be addressed through disclosure and informed client consent.

In light of the controversy surrounding the release, we predict that the SEC will either choose not to move forward with the interpretation at this time or modify it to delete the more controversial interpretations for which there is no existing strong precedent.

The public had until August 7, 2018 to submit comment letters regarding the proposal. There was general support amongst commenters that the SEC’s proposals were well-intentioned and that the SEC should continue to take a lead on formulating a best interest standard for broker-dealers. However, many commenters felt the SEC’s proposal was vague and went far beyond current broker-dealer obligations. Many commenters hoped the final rules would show significant improvements over the proposals.

William Galvin submitted a comment letter to the SEC criticizing the proposed Regulation Best Interest and suggested that, absent the SEC’s withdrawal of the proposal, “Massachusetts is prepared to adopt a fiduciary standard for broker-dealers.” Meanwhile, the attorneys general of New York, California, Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New Mexico, Oregon, Pennsylvania, Rhode Island, Vermont, Washington and the District of Columbia submitted a comment letter calling for a uniform fiduciary standard and, inter alia, for Regulation Best Interest to “require the elimination of certain conflicted compensation incentives that cannot be sufficiently mitigated and to base any differential compensation to individuals on neutral factors.”

William Galvin submitted a comment letter to the SEC criticizing the proposed Regulation Best Interest and suggested that, absent the SEC’s withdrawal of the proposal, “Massachusetts is prepared to adopt a fiduciary standard for broker-dealers.” Meanwhile, the attorneys general of New York, California, Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New Mexico, Oregon, Pennsylvania, Rhode Island, Vermont, Washington and the District of Columbia submitted a comment letter calling for a uniform fiduciary standard and, inter alia, for Regulation Best Interest to “require the elimination of certain conflicted compensation incentives that cannot be sufficiently mitigated and to base any differential compensation to individuals on neutral factors.”

State Developments

As we noted early in the year, 2018 promised to be very eventful at the state level driven in large measure by a perception that regulatory rollback was well afoot at the federal level. It did not fail to deliver. Regulators and legislators in New Jersey, New York, Nevada and Maryland, among others, raced to fill a perceived void created by federal deregulation. The National Association of Insurance Commissioners (NAIC) also was hard at work in an attempt to form a model standard of conduct for states to follow in connection with the sale of life insurance products.

On October 15, the New Jersey Bureau of Securities (Bureau) issued a notice of pre-proposal to solicit comments on whether to adopt rule amendments that would require broker-dealers, agents, investment advisers and investment adviser representatives to be subject to an express fiduciary duty. The notice highlighted concerns that investors are often unaware of whether and to what extent those they trust to make financial recommendations are receiving undisclosed financial benefits in exchange for steering their clients to certain products.9 The pre-proposal did not include any specific language, but the Bureau did indicate it was considering “making it a dishonest or unethical business practice for failing to act in accordance with a fiduciary duty when recommending to a customer, an investment strategy, or the purchase, sale, or exchange of any security or securities, or providing investment advisory services to a customer.”10 The Bureau held two public hearings last November; the comment period closed on December 14. The Bureau currently expects to release a formal proposal in the first quarter of 2019, followed again by another comment period. This timeline could be extended, depending on when the SEC finalizes its standards of conduct rulemaking. The Bureau could also shelve its proposal if the final Regulation Best Interest is modified in such a way as to assuage state legislatures and regulators.

Early in 2018, the New Jersey Senate reintroduced a bill that would have required non-fiduciary investment advisers to make a plain language disclosure stating that they are not required to act in the client’s best interest, that they are allowed to recommend investments that earn them higher fees, and also keep records of the client’s acknowledgement of those disclosures. The bill stalled. With that said, we understand that the sponsor of the bill has not lost faith and is open to re-introducing the bill this session. It may simply be a matter of politics if legislation is introduced while the Bureau works through its regulatory process.

New Jersey has certainly not been alone. Early last year, New York Assemblyman Jeffrey Dinowitz introduced the Investment Transparency Act, which would have required brokers, dealers, investment advisers and other financial planners that are not otherwise subject to a fiduciary standard under existing state or federal law to make a “plain language disclosure to clients orally and in writing” at the outset of the relationship that states:

I am not a fiduciary. Therefore, I am not required to act in your best interests, and am allowed to recommend investments that may earn higher fees for me or my firm, even if those investments may not have the best combination of fees, risks, and expected returns for you.11

The bill’s language is virtually identical to the New Jersey bill we noted above. While the Investment Transparency Act did not advance to a floor vote following a third reading before the State Assembly in May 2018, Dinowitz has indicated that he plans to re-propose legislation.

One of the most significant state developments over the past year occurred on July 18, 2018 when New York’s Department of Financial Services (NYDFS) approved an amendment to its insurance regulation to impose a “best interest” standard on the sale of life insurance and annuity contracts.12 Specifically, the regulation requires insurers and “producers” to establish standards and procedures for recommendations to consumers with respect to annuity contracts or insurance policies delivered or issued for delivery in the state, so that any transaction with respect to those policies is in the best interest of the consumer and appropriately addresses the insurance needs and financial objectives of the consumer at the time of the transaction. The amendment is to take effect on August 1, 2019 for annuity contracts and February 1, 2020 for life insurance policies.

The New York regulation marked a sea change and raised concerns about what might happen with the NAIC model drafting process as well as in other jurisdictions. The regulation not only heightened the standard of care owed by the sellers of life insurance products, but also vastly expanded the breadth of the products covered from annuities to all life insurance products, including term life insurance. Some industry groups quickly challenged the NYDFS regulation.13 Does this regulation presage how other states respond to the rollback of regulations at the federal level?

On that point, the outcome of the NAIC’s model rulemaking process is of particular note. The NAIC committee tasked with revising the NAIC’s model suitability rule for the sale of annuity products was hard at work in 2018 seeking to revise its current “suitability” standard for the sale of annuity products with a rule that would apply a “best interest” standard. The committee faced great debate among NAIC members regarding among the future of the model rule. With states like New York and California leading the charge, the NAIC was pressured to adopt a rule that, like New York’s regulation, would impose a best interest standard for the sale of both annuity and life insurance products. Other states have pushed back, arguing that such an approach goes too far and would be unlikely to pass in many state legislatures. Because the NAIC is working to harmonize its advice standards with those of the SEC, it is unlikely that NAIC will have its final model rule promulgated until after the SEC finalizes its rule. The future of the NAIC’s model regulation will continue to be a hot topic of debate in 2019.

Maryland is also worth watching. Last May, legislation passed in the House and Senate as part of a larger financial reform bill (titled the Financial Consumer Protection Act of 2018), which instructed the Maryland Financial Consumer Protection Commission (the MFCPC) to study the DOL’s 2016 fiduciary rule and SEC’s proposed Regulation Best Interest, to determine whether it would be in the best interest of the state to adopt its own fiduciary rule. The MFCPC has since held two public hearings where it has heard testimony from interested parties. Last we heard, the MFCPC hopes to issue a final report and draft fiduciary rule to Maryland’s General Assembly and to the Governor any day now. Although there seems to be some support for such a rule in the Maryland legislature, Chair Gary Gensler has recognized that adopting a new fiduciary standard will be a “tough lift” for the General Assembly.

Though the passage of a Nevada bill in 2017, which imposed a statutory fiduciary duty on broker-dealers, sales representatives, and investment advisers14 was met with great fanfare and surprise, it left financial services firms that were subject to the new law in limbo because its scope and core requirements were left to the Nevada Securities Division to decide. While repeatedly promised, a regulation explaining how this uniform fiduciary standard was to work in practice, and whether firms registered with the SEC would be exempted, has yet to materialize. The Nevada Securities Division has been made aware of the preemption concerns by reason of The National Securities Markets Improvement Act of 1996 (NSMIA) and other federal law, which may be the holdup.

Last April, we noted, “Nevada Democratic Senate Majority Leader Aaron Ford, the sponsor of the legislation (who subsequently announced his intention to run for state attorney general), said in an interview that he is ‘confident’ the law will ‘comport with what the federal government may do,’ specifically referencing the DOL Fiduciary Rule.” We also mentioned that, “Ford intimated that he and others would not hesitate to send the Securities Division back to the drawing board if the regulation does not reflect (enough) of their legislative intent. He also vowed, ‘We’ll be back again in 2019’ should the law be struck down by a court on preemption grounds.” Since then, Ford has won his race for state attorney general. We wonder if this means Nevada pursues its agenda of imposing a uniform fiduciary standard through the courts (e.g., filing suit against a final SEC rulemaking) rather than through the legislature.

Also on the legislative front, Illinois took a preliminary step toward promulgating a standard of care for investment advisers. On February 13, 2018, Illinois introduced the Investment Advisor Disclosure Act. While the bill does not yet provide any text, it appears to target disclosure-related standards and mimics the approach taken by New York in its proposed Investment Transparency Act. It also has yet to advance.

With the states’ legislative approach to addressing the standards of conduct issue largely unsuccessful, we expect most states will await final rulemaking from the SEC and the NAIC, and only then propose and promulgate regulations directly or indirectly imposing uniform standards of care. We do not expect many other states, besides the ones already mentioned, to be involved (with one or two exceptions). While regulations may face better odds than legislation, they also remain vulnerable to court challenge that the regulator acted beyond its powers. This means that litigation both by, and against, the states involved, such as New York and potentially New Jersey, will likely characterize state activity regarding broker-dealer and investment adviser standards of conduct in 2019.

Proxy Voting

On September 13, 2018, Clayton announced a review of all SEC staff guidance to determine if prior positions “should be modified, rescinded or supplemented in light of market or other developments.”15 In conjunction with the Chairman’s statement, IM staff withdrew two interpretive letters that gave guidance to investment advisers seeking to comply with the proxy voting requirements of rule 206(4)-6 under the Advisers Act, which, among other things, requires investment advisers to vote client securities in the best interest of clients and to describe how they address material conflicts of interest between themselves and the clients on whose behalf they are voting.16 While rule 206(4)-6 does not dictate how an investment adviser must address conflicts, the adopting release discusses options, including engaging a third party to vote a proxy involving a material conflict or voting in accordance with a pre-determined policy based on recommendations of an independent party. The letters addressed how investment advisers that have a material conflict can determine that a proxy advisory firm is capable of making impartial recommendations in the best interests of the adviser’s clients. The SEC left in place 2014 staff guidance that enshrines the principles of the two interpretive letters.17

IM staff indicated in its statement that its withdrawal of the letters was designed to “facilitate discussions” at the Roundtable on the Proxy Process,18 which was held in November, and that staff was seeking views on the 2014 staff guidance. The U.S. Chamber of Commerce and some corporate secretaries have criticized proxy advisory firms for years, claiming proxy advisory firms lack transparency and accountability, and as part of these efforts, the corporate community has lobbied to withdraw the letters.19 Legislative efforts to directly regulate proxy advisory firms also have been proposed.20

John Baker and Michael Wallace attended the Staff Roundtable on the proxy process on November 15, 2018. The Roundtable consisted of three panels on each of the following topics: (1) proxy voting mechanics and technology; (2) shareholder proposals; and (3) the role of proxy advisory firms. Clayton opened the discussion by expressing his personal goal to improve the quality of the voting process for long term investors, such that they can make more informed, company-specific voting decisions. He requested that the panel continue to work on and present recommendations for change to the SEC. Notably, Clayton did not make the same request after the other two panel discussions. Also notable was the absence of any discussion at all about the two interpretive letters from 2004, which were recently withdrawn by the SEC. Much of the panel’s time was spent discussing how proxy advisory firms operated, what services they provide, and how those services are used by asset managers, investment advisers, and issuers.

In December, Clayton gave a speech that included priorities for the SEC in 2019.21 Among other things, he indicated that improving the proxy process is a significant initiative. With regard to proxy advisory firms, Clayton indicated that “there should be greater clarity regarding the division of labor, responsibility and authority between proxy advisors and the investment advisers they serve.” Additionally, Clayton pointed to the need for “clarity regarding the analytical and decision-making processes advisers employ,” and indicated that “it is clear to me that some matters put to a shareholder vote can only be analyzed effectively on a company-specific basis, as opposed to applying a more general market or industry-wide policy.” Clayton indicated that he intended to move forward with staff recommendations.

ESG

Environmental, social and/or governance issues are a fact of life. Cybersecurity and climate change are two examples. Some investment funds that incorporate ESG factors, for instance, scrutinized their holdings in Facebook because they viewed the recent privacy scandals “as the digital equivalent of a toxic waste spill,”22 while other funds and managers focus on the myriad other environmental (E), social (S) and/or governance (G) issues and risks when making investment decisions. ESG continues to proliferate at breakneck speed across asset classes. In fact, we’re helping both our registered and private fund clients incorporate various ESG strategies, and advising fiduciaries on the fiduciary implications, such as how integration, shareholder engagement and divestment can be conducted in a manner consistent with ERISA. We simply don’t see ESG going away anytime soon.

We also appreciate that there is widespread confusion over what ESG actually means. How does “ESG investing” differ from “impact investing,” “socially responsible investing,” “economically targeted investing,” and “sustainable investing”? It is also helpful to remember that gone are the days when ESG investing consisted primarily of either screening out, or divesting, of certain issuers/sectors because they did not meet some moral or other non-economic test. Today’s ESG is much more driven by data linking one or more ESG factors and investment performance – i.e., an ESG factor can now be a material risk. On an even more fundamental level, there is not unanimity on what constitutes an E, S or G factor. ESG is an umbrella term capturing as many as 40 different topics. To better align fiduciary duty nuance and industry practice, George Michael Gerstein, in An ESG Proposal for You, proposed this glossary:

ENGAGEMENT: Exercising one or more rights of a holder of interests in an ISSUER, such as proxy voting, introducing resolutions or participating in formal or informal meetings with the ISSUER board, in respect of an ESG FACTOR where (A) the exclusive purpose is to enhance portfolio return or reduce portfolio risk, (B) the primary purpose is for non-investment performance reasons, such as the promotion of an ESG policy, and a secondary purpose is to enhance portfolio return or reduce portfolio risk or (C) the exclusive purpose is for one or more non-investment performance reasons, such as the promotion of an ESG policy.

ENVIRONMENTAL: Issues or facts related to the natural environment, such as climate change, carbon emissions, waste management, recycling, energy, biodiversity, pollution, and conservation.

ESG (FACTOR): ENVIRONMENTAL, SOCIAL and/or GOVERNANCE-related issues or facts.

ESG INVESTING: Employing NEGATIVE SCREENING, POSITIVE SCREENING, THEMATIC INVESTING, INTEGRATION, ENGAGEMENT, IMPACT INVESTING, SOCIALLY RESPONSIBLE INVESTING, RESPONSIBLE INVESTING AND/OR SUSTAINABLE INVESTING.

EXCLUSIONARY SCREENING: See NEGATIVE SCREENING.

GOVERNANCE: Issues or facts related to the governance of an ISSUER, such as executive compensation, board structure, shareholder rights, bribery and corruption, and cybersecurity.

IMPACT INVESTING: Selecting investments in respect of an ESG FACTOR where the primary purpose is for non-investment performance reasons, such as the promotion of an ESG public policy, and a secondary purpose is to enhance portfolio return or reduce portfolio risk.

INTEGRATION: Incorporating ESG-related data and/or information in respect of an ESG FACTOR into the usual process when making an investment decision where such data or information is material to investment performance and where the exclusive purpose is to enhance portfolio return or reduce portfolio risk.

ISSUER: Any issuer, such as a corporation or country, whether in the public or private markets, that issue investible holdings, whether a security or not, in which an investment can be made.

NEGATIVE SCREENING: Avoiding the purchase of prospective investments, or DIVESTING from existing investments, on the basis of such investments not meeting a designated ESG standard, rating or requirement where (A) the exclusive purpose is to enhance portfolio return or reduce portfolio risk, (B) the primary purpose is for non-investment performance reasons, such as the promotion of an ESG public policy, and a secondary purpose is to enhance portfolio return or reduce portfolio risk or (C) the exclusive purpose is for one or more non-investment performance reasons, such as the promotion of an ESG public policy. Also called EXCLUSIONARY SCREENING.

POSITIVE SCREENING: Selecting investments on the basis of meeting a designated ESG standard, rating or requirement where (A) the exclusive purpose is to enhance portfolio return or reduce portfolio risk, (B) the primary purpose is for non-investment performance reasons, such as the promotion of an ESG public policy, and a secondary purpose is to enhance portfolio return or reduce portfolio risk or (C) the exclusive purpose is for one or more non-investment performance reasons, such as the promotion of an ESG public policy.

RESPONSIBLE INVESTING: Selecting investments where (A) the primary purpose is for non-investment performance reasons, namely the promotion of a GOVERNANCE ESG FACTOR, and a secondary purpose is to enhance portfolio return or reduce portfolio risk or (B) the exclusive purpose is for one or more non-investment performance reasons, namely the promotion of a GOVERNANCE ESG FACTOR.

SOCIAL: Issues or facts related to human relations of an ISSUER, such as employee relations, community relations, board diversity, human rights, demography, food security, poverty/inequality, child labor and health and safety.

SOCIALLY RESPONSIBLE INVESTING: Selecting investments where (A) the primary purpose is for non-investment performance reasons, namely the promotion of a SOCIAL ESG FACTOR, and a secondary purpose is to enhance portfolio return or reduce portfolio risk or (B) the exclusive purpose is for one or more non-investment performance reasons, namely the promotion of a SOCIAL ESG FACTOR.

SUSTAINABLE INVESTING: Selecting investments where (A) the primary purpose is for non-investment performance reasons, namely the promotion of an ENVIRONMENTAL ESG FACTOR, and a secondary purpose is to enhance portfolio return or reduce portfolio risk or (B) the exclusive purpose is for one or more non-investment performance reasons, namely the promotion of an ENVIRONMENTAL ESG FACTOR.

THEMATIC INVESTING: Utilizing NEGATIVE SCREENING, POSITIVE SCREENING, INTEGRATION and/or ENGAGEMENT to invest in ISSUERS that share a common ESG purpose, industry or product.

On April 23, 2018, the DOL issued Field Assistance Bulletin 2018-01. At the time of its publication, we noted that it, “reflects an unease by the DOL over certain ESG practices and largely clarifies existing fiduciary obligations in this space.” Specifically, FAB 2018-01 preserved integration as an ESG approach. As defined above, integration is where the fiduciary thinks that one or more ESG factors will have a material impact on investment performance. There is a good amount of data coming out that links investment performance with various (but not all, yet) ESG factors.

We think the DOL might prefer integration as an ESG approach over strategies that make investment decisions for moral reasons or to otherwise promote a public policy. The DOL stressed the importance of documenting why the fiduciary believes the respective ESG factor will have a material effect on performance, without having to make a series of wishful assumptions to reach that conclusion. We suggested that, “fiduciaries will want to build a record in support of the view that a particular factor bears a relationship with investment performance, and carefully consider how much weight to put on that specific factor.”

FAB 2018-01 also warned plan fiduciaries against selecting an ESG-themed fund as a qualified default investment alternative (QDIA) for purposes of section 404(c) of ERISA. However, we thought the DOL left open the possibility of selecting a QDIA that integrates ESG factors, again, seemingly demonstrating a preference for that approach.

We also noted in April that the DOL “zeroed-in on shareholder engagement in respect of ESG issues that have a connection to the value of the plan’s investment in the company, where the plan may be paying significant expenses for the engagement or development of proxy resolutions.” If anything, this aspect of FAB 2018-01 has the most significant ramifications. If plans are viewed as paying indirectly for engagement through the management fee, which view we think the DOL takes, then proxy voting and other forms of shareholder engagement need to be monitored for both costs and benefits, particularly as the time spent on the engagement increases.

On May 22, 2018, the Government Accountability Office (GAO) released a report on ERISA fiduciaries’ incorporation of ESG factors into its investment process. Though the report provides a really helpful overview of ESG’s evolution, we noted the following:

Rather unfortunately, the report was largely completed prior to the DOL’s issuance of Field Assistance Bulletin (FAB) 2018-01, which we discussed here. The principal recommendation by the GAO is for the DOL to issue guidance on whether a fiduciary can incorporate ESG factors into the management of a default investment option in a defined contribution plan. As you may know, FAB 2018-01 seemed to do just that, though not in an entirely clear manner. Nevertheless, the GAO addressed FAB 2018-01 at the end of the report and narrowed its initial recommendation, namely, that the DOL better explain how fiduciaries can utilize the integration strategy in a QDIA. In the DOL’s defense, FAB 2018-01 seems to address (to some extent) whether a QDIA can utilize the integration strategy; the DOL instead hit the brakes on offering a themed ESG product as a QDIA.

In our view, ESG will continue to evolve and proliferate, while also garnering the attention of both the DOL and SEC on a number of levels. ESG is, in essence, entirely fluid and will continue to present business opportunities and compliance challenges. We will likely have more to say on this in the coming weeks.

_________

1 Citing Chamber of Commerce of the U.S.A. v. U.S. Dep't of Labor, No. 17-10238, slip op. 46 (5th Cir. Mar 15, 2018).

2 See Regulation Best Interest, SEC Rel. No. 34-83062 (April 18, 2018); Form CRS Relationship Summary; Amendments to Form ADV; Required Disclosures in Retail Communications and Restrictions on the use of Certain Names or Titles, SEC Rel. Nos. 34-83063; IA- 4888 (April 18, 2018); Proposed Commission Interpretation Regarding Standard of Conduct for Investment Advisers; Request for Comment on Enhancing Investment Adviser Regulation, SEC Rel. No. IA-4889 (April 18, 2018).

3 Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No. 111-203, § 913, 124 Stat. 1376, 1824-30 (2010).

4 A “retail customer” is proposed to be defined under Regulation Best Interest as a person who receives a recommendation and uses it primarily for personal, family or household purposes.

5 “Recommendation” is not defined but is proposed to be interpreted consistent with existing FINRA rules, under which factors that have historically been considered in the context of broker-dealer suitability obligations include whether the communication “reasonably could be viewed as a ‘call to action’” and “reasonably would influence an investor to trade a particular security or group of securities.”

6 Regulation Best Interest, Release No. 34-83062 (April 18, 2018), available at https://www.sec.gov/rules/proposed/2018/34-83062.pdf.

7 For purposes of the Form CRS delivery requirement, a “retail investor” is proposed to be defined as a prospective or existing client or customer who is a natural person, including a trust or other similar entity that represents natural persons.

8 The form would not supersede the Form ADV Part 2 brochure, which investment advisers would continue to prepare and provide to clients.

9 Both New Jersey and FINRA rules require securities recommendations to meet a suitability standard. See N.J. Admin. Code § 13:47A-6.3(a)(3); FINRA Rule 2111.

10 50 N.J.R. 2142(a) (Oct. 15, 2018).

11 An Act to Amend the General Obligations Law, in Relation to Mandating Greater Levels of Disclosure by Non-Fiduciaries that Provide Investment Advice, New York State Assembly, A02464A (N.Y. 2017), available at https://nyassembly.gov/leg/?default_fld=&leg_video=&bn=A02464&term=2017&Summary=Y&Actions=Y&Memo=Y&Text=Y.

12 Suitability and Best Interests in Life Insurance and Annuity Transactions, New York State Department of Financial Services, First Amendment to 11 NYCRR 224.

13 For example, the National Association of Insurance and Financial Advisors of New York filed a lawsuit in November 2018 against the NYDFS in New York’s Supreme Court alleging various claims regarding the regulation’s constitutionality. To view the complaint, please visit: https://www.investmentnews.com/assets/docs/CI1180381126.PDF.

14 Assembly Amendment to S.B. 383, 79th Sess. (Nev. 2017), available at https://www.leg.state.nv.us/App/NELIS/REL/79th2017/Bill/5440/Text#.

15 Statement Regarding SEC Staff Views, available at https://www.sec.gov/news/public-statement/statement-clayton-091318. The Chairman noted that other federal financial agencies had instituted similar reviews of staff guidance.

16 Statement Regarding Staff Proxy Advisory Letters, available at https://www.sec.gov/news/public-statement/statement-regarding-staff-proxy-advisory-letters. Commissioner Jackson issued a statement in conjunction with the Investor Advisory Committee meeting critical of IM staff’s withdrawal of the letters. Statement on Shareholder Voting, available at https://www.sec.gov/news/public-statement/statement-jackson-091418.

17 Staff Legal Bulletin No. 20 (June 30, 2014), available at https://www.sec.gov/interps/legal/cfslb20.htm.

18 Statement Announcing SEC Staff Roundtable on the Proxy Process, available at https://www.sec.gov/news/public-statement/statement-announcing-sec-staff-roundtable-proxy-process.

19 See, e.g., Statement of the U.S. Chamber of Commerce on the Market Power and Impact of Proxy Advisory Firms (June 5, 2013) (“For a number of years, the Chamber has expressed its long-standing concerns with . . . proxy advisory firms”), available at https://www.centerforcapitalmarkets.com/wp-content/uploads/2010/04/2013-6.3-Pitt-Testimony-FINAL.pdf; James K. Glassman and J.W. Verret, “How to Fix our Broken Proxy Advisory System,” (2013) (recommending that the letters be rescinded to “[e]nd the preferential regulatory treatment that proxy advisors currently enjoy in the law”). Both the corporate community and the asset management industry discussed their views on the letters and proxy advisory firms generally in a prior SEC roundtable in 2013. See Transcript of the Proxy Advisory Firms Roundtable (Dec. 5, 2013), available at https://www.sec.gov/spotlight/proxy-advisory-services/proxy-advisory-services-transcript.txt

20 For example, HR 5311 was introduced in May 2016 and later folded into the Financial CHOICE Act. More recently, in October 2017, HR 4015, which is mostly a resubmission of HR 5311 was introduced. These bills generally require registration of proxy advisory firms with the SEC, and require firms to meet extensive disclosure requirements relating to methodologies and conflicts of interest, require firms to hire an ombudsperson to handle complaints, and give corporate issuers the ability to vet proxy advisory firms’ recommendations before the recommendations are released.

21 SEC Rulemaking Over the Past Year, the Road Ahead and Challenges Posed by Brexit, LIBOR Transition and Cybersecurity Risks, available at https://www.sec.gov/news/speech/speech-clayton-120618.

22 Emily Chasan, Facebook Turns Toxic for Some ESG Funds, Bloomberg, March 26, 2018.

Information contained in this publication should not be construed as legal advice or opinion or as a substitute for the advice of counsel. The articles by these authors may have first appeared in other publications. The content provided is for educational and informational purposes for the use of clients and others who may be interested in the subject matter. We recommend that readers seek specific advice from counsel about particular matters of interest.

Copyright © 2018 Stradley Ronon Stevens & Young, LLP. All rights reserved.